Revised cycle-high target for gold to $3,300. Timing is expected in late-Q1 to early-Q2 2025. Detailed analysis reported below.

Upside constraints on gold should ease with the passing of options expiration on Tuesday and free its price for advancement to its next target in the $2,600s.

Gold traded flat and range-bound this week likely due to the constraints from the coming options expiration which is now two trading days away. Considering how stretched price already was above its option-based equilibrium (i.e. max-pain price of $2,405), the upside for gold was limited. Conversely, downside pressure was restrained by the former 3yr MA (+28%) resistance level becoming support after last week’s breakout. The expectation remains that once option expiration is behind us, the gold price would be less constrained to make its final advance during this daily-cycle and up towards the 3yr MA (+35%) target which is currently in the $2,600s, as shown in Figure 1.

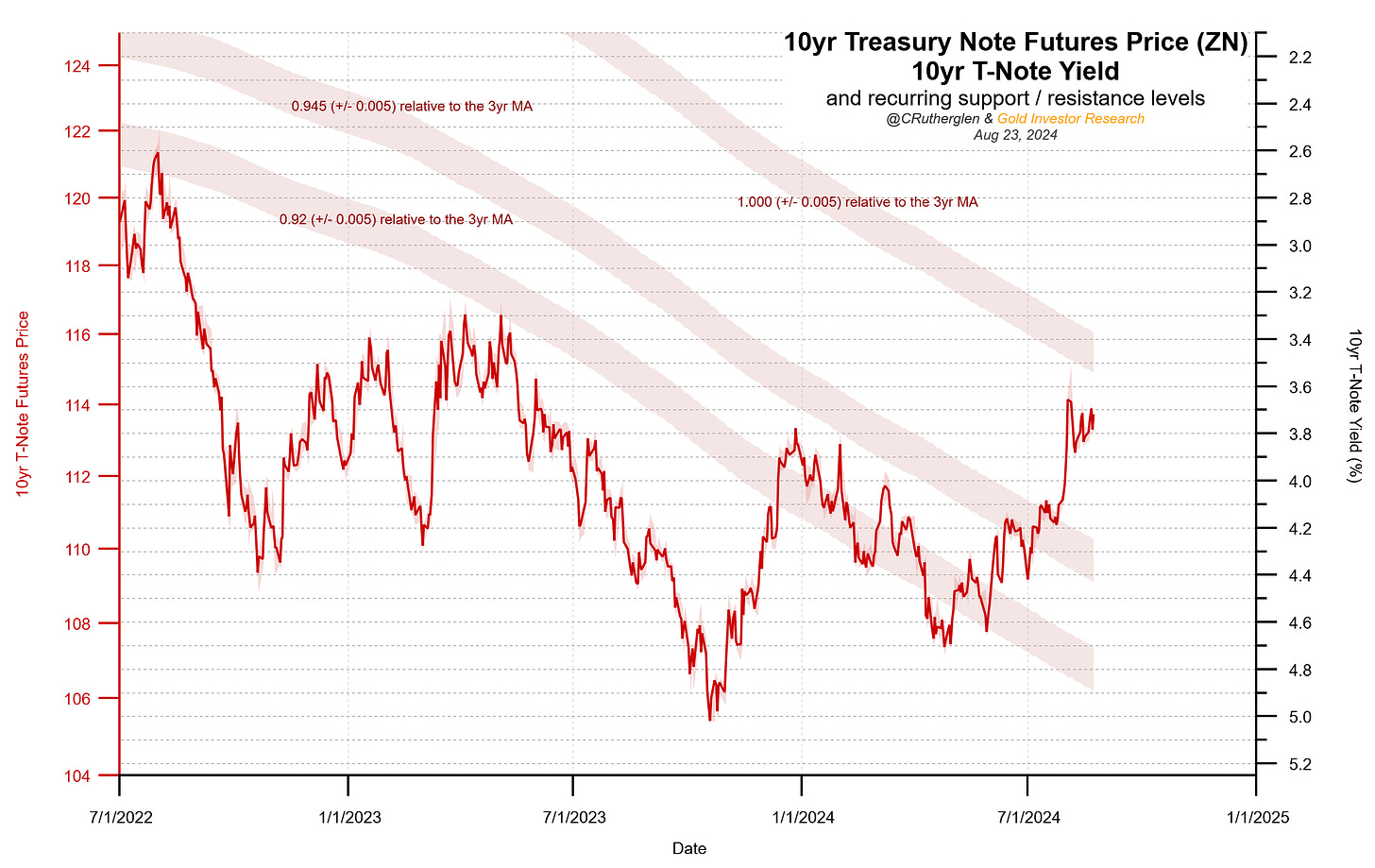

Assisting gold move higher is expected to be rising bond prices or conversely falling long-term yields. The 10yr T-Note continues to coil in an apparent bullish ascending triangle pattern. A break higher would likely see yields fall an additional 30 to 40bp to around 3.5% on the 10yr yield. For gold, this would translate to a +7% to +10% move for the gold price based on the yield factor alone.

With that said, the advance for this current daily-cycle is getting mature and is closing in on its local-high. Since last Friday break higher for gold, the put:call volume ratio has begun trending higher suggesting that put option (or downside protection) activity is increasing relative to call options. Looking at prior local-highs for gold since the March 2024 breakout, they have all occurred well into a rising put:call options ratio as shown in Figure 4.

The Case for a $3,300 Gold Price Target

Stepping back to get a big-picture of this post-consolidation breakout advancing move for gold, we can see in Figure 5 that relative to the 2007 analog, the current cycle is proceeding on a more relaxed timeline.