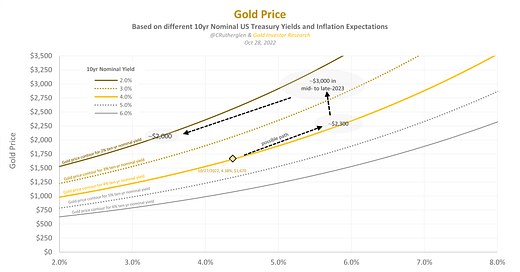

Historical look-back at drivers for gold during prior interest-rate cycles

And what that portends for the gold price in 2023

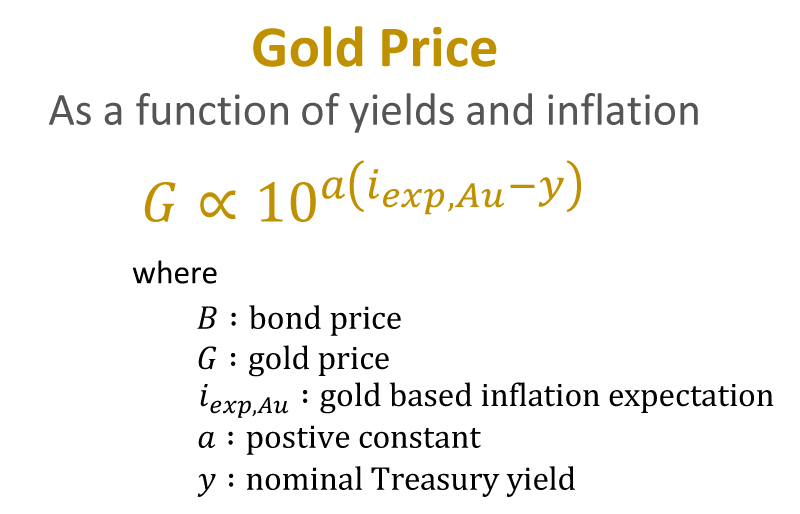

Continuing our discussion (here & here) on the interplay between the gold price, the 10yr yield and the inflation expectation, lets look at prior interest-rate cycles to see how this dynamic played-out over time. Examining these historical instances will provide useful context on how to interpret the current setup and what we may expect in the coming year as the interest-rate-cycle progresses. As readers will recall, the gold price is exponentially related the inflation expectation less the 10yr Treasury yield as shown below. Thus, if one can express an opinion directionally on where those two factors are going, then one can gain clarity on gold as well.