Today we are getting a more definitive breakdown for gold below its recent double-top pattern’s support level.

The next step will be the break of its upward sloping trendline shown in Figure 2. After that, the gold price should begin entering our intermediate cycle low (ICL) target zone between $3,050 to $3,150. Due to the falling gold price, its 100d EMA support level is flattening out which is occurring just below the $3,050 level. Considering that the max-pain price for the Jun’25 gold options contract is also steady around $3,050, I suspect the low is likely to form around that level which would constitute the lower end of our ICL target range.

The target zone can alternatively be view on our normalized gold price charts shown below.

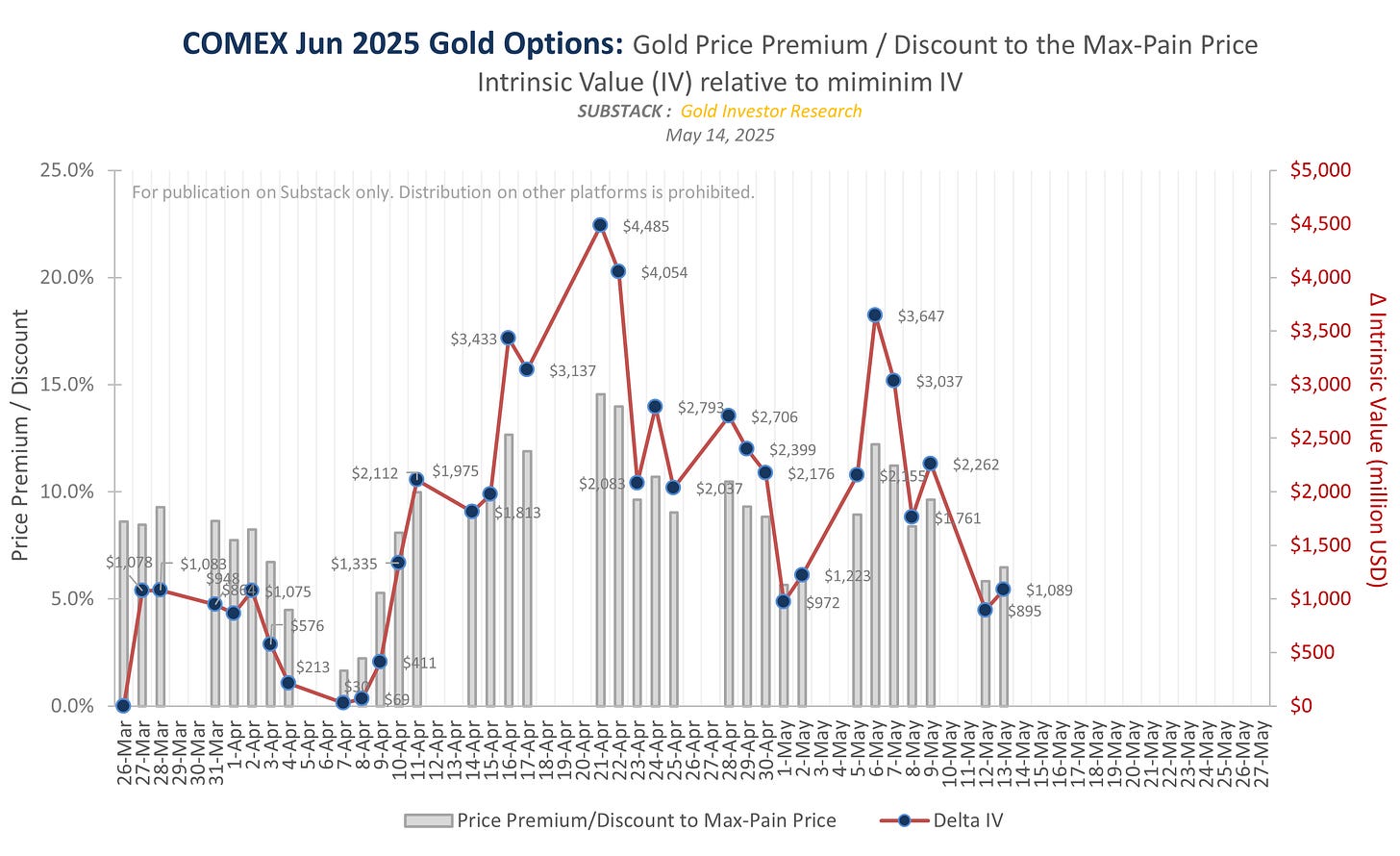

Nine trading days remain until expiration of the large, Jun’25 gold options contract and the declining gold price is bringing it back into equilibrium. Based on today’s price decline, the contract’s delta-intrinsic value is now down to $500 million which is a much more reasonable level compared to its extremely stretched value of nearly $4.5 billion at the recent gold highs as shown in Figure 7. By the time of options expiration on May 27th, we expect that number to be down to less than $250 million.

We are still looking for the ICL to occur around the end of May because downward pressure on price will be relieved once the Jun’25 options contract is behind us. After that, we will be into the Jul’25 gold options contract where its max-pain price is over $100 higher and now up to $3,160. This suggests that if price does get down to around $3,050 for the low, the options related pressure on price will shift to being upwards once we get into the month of June.